What 3,000+ Rent Calculations Revealed About America's Patchwork Landlord-Tenant Laws

The Data Behind 3,000 Rent Calculations

When we launched RentLateFee.com three months ago, we expected a simple tool: look up state law, apply formula, show result. What we discovered instead was a complex web of legal variations, edge cases, and widespread confusion that affects millions of landlords and tenants across America.

After analyzing 3,625 calculator uses across all 50 states, we uncovered patterns that challenge common assumptions about rental law and reveal just how difficult legal compliance actually is for the average property owner.

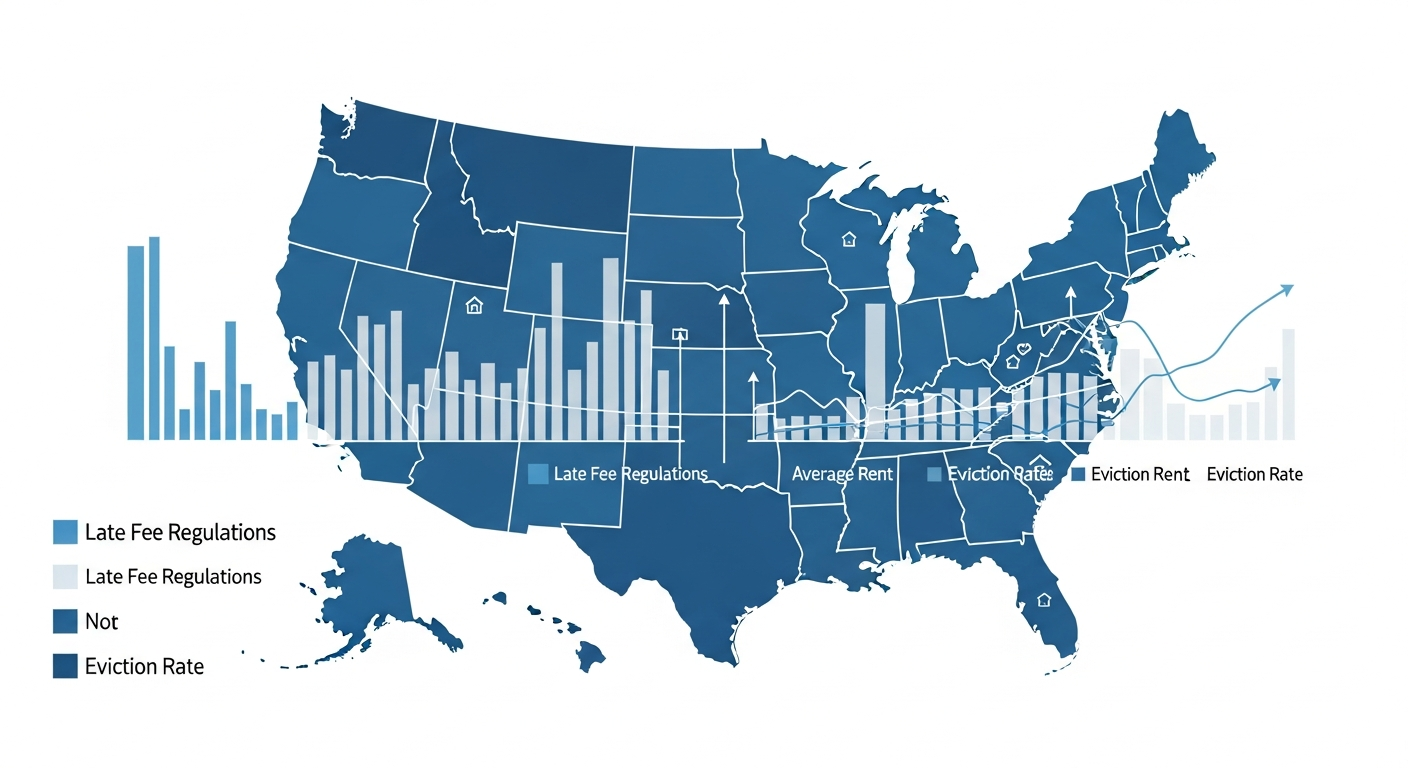

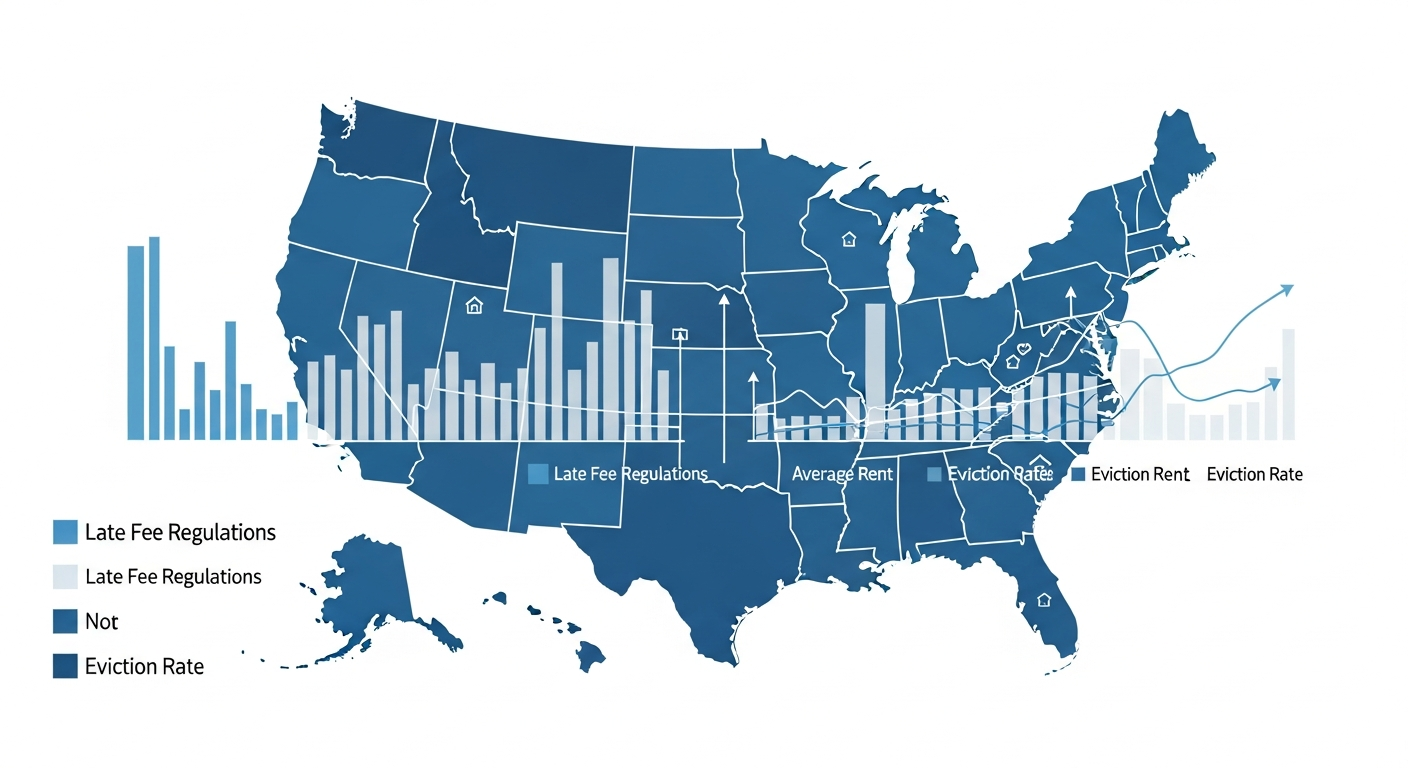

The Geographic Distribution: California Dominates

Our data shows a clear concentration of searches in states with the most ambiguous rental laws:

| State | Calculator Uses | % of Total | Key Issue |

|---|---|---|---|

| California | 2,327 | 64% | "Reasonable" standard with no cap |

| Texas | 192 | 5.3% | Different rules for building size |

| Illinois | 156 | 4.3% | Case law-based reasonableness |

| Florida | 141 | 3.9% | No grace period requirement |

| New York | 112 | 3.1% | $50 or 5% cap confusion |

The California dominance is striking. With 64% of all calculator uses, landlords and tenants in the Golden State are clearly struggling with a legal framework that offers no specific cap, only the vague requirement that fees be "reasonable" under Civil Code § 1671.

The Five Calculation Methods That Complicate Everything

One of our most surprising findings was the discovery that states use fundamentally different mathematical approaches to calculate maximum late fees. We identified five distinct calculation methods:

1. Percentage Only (21 states)

The simplest approach: a flat percentage of monthly rent. Texas allows 12% for small buildings, Minnesota caps at 8%. Straightforward for landlords to calculate.

2. Flat Dollar Only (3 states)

States like Delaware set a simple dollar cap ($40 maximum) regardless of rent amount. This creates an unusual situation where a tenant paying $3,000/month faces the same maximum fee as one paying $800.

3. Greater Of (8 states)

Utah exemplifies this complexity: the law allows "10% of rent OR $75, whichever is greater." For rent under $750, landlords can charge $75. Above $750, they can charge 10%. This creates a non-linear relationship that requires careful implementation.

This is where community-driven development proved invaluable. When we launched on Hacker News, the developer community immediately spotted edge cases in our Utah implementation. Within hours, we had corrected the formula and added comprehensive tests. This kind of real-time feedback from technical users is exactly why open community launches matter for legal tools where accuracy is critical.

4. Lesser Of (6 states)

The inverse approach: New York caps fees at "$50 OR 5% of rent, whichever is less." For a $1,000 rent, the 5% calculation yields $50, matching the flat cap. But for $2,000 rent, the percentage would be $100, so the $50 flat cap applies. Landlords charging $100 would be violating state law.

5. Reasonable Standard (12+ states)

The hardest to calculate: California, Illinois, and others require fees to be "reasonable" without specifying a number. Courts have established 5-7% as generally defensible, but there's no guarantee. The landmark Orozco v. Casimiro (2004) case voided a $50 late fee in California because the landlord couldn't demonstrate actual damages.

Grace Periods: The Hidden Compliance Trap

Beyond the fee calculation itself, grace periods add another layer of complexity. Our data revealed a common failure pattern: landlords know their state's fee cap but miss the grace period requirement entirely.

Connecticut requires a 9-day grace period, the longest in the nation. A landlord who charges a late fee on day 3 isn't just being aggressive; they're violating state law regardless of how reasonable the fee amount is.

| Grace Period | States |

|---|---|

| 9-10 days | Connecticut (9), Idaho (10) |

| 5-7 days | Colorado (7), Delaware, DC, Kentucky, Maryland, NJ, NY, Tennessee (5) |

| 2-4 days | Texas (2 full days), Oregon (4) |

| None required | Florida, Georgia, and 20+ other states |

What the Data Tells Us About User Confusion

Analyzing search patterns and repeat visits, we identified three primary sources of confusion:

1. The "Reasonable" Paradox (32% of searches)

Users in California and other "reasonableness" states return to the calculator repeatedly, often with different fee amounts. They're testing scenarios to understand what might be considered reasonable. The law provides no clear answer, so they seek reassurance from a tool that can only point to industry benchmarks.

2. Building Size Rules (18% of Texas searches)

Texas Property Code § 92.019 allows different percentages based on building size: 12% for 4 or fewer units, 10% for 5+ units. Users frequently enter the same rent amount twice with different building configurations, suggesting they're unsure which category applies to their property.

3. Daily Accrual Questions (11% of all searches)

Can landlords charge additional fees each day rent remains unpaid? The answer varies dramatically by state. Oregon allows daily fees at 6% of the base fee or 5% of rent (whichever is greater), but most states prohibit compounding. Users searching for daily accrual information often can't find clear answers in their leases.

Technical Challenges We Didn't Anticipate

Building a legal compliance calculator taught us that the hardest problems aren't algorithmic, they're definitional.

Challenge 1: Defining "Rent"

Is "rent" just the base payment, or does it include recurring fees like pet rent, parking, or utilities? State laws vary. Virginia calculates late fees on the "remaining balance," which could include these charges. California focuses on "periodic rent" which typically excludes one-time or variable fees.

Challenge 2: What Counts as "Late"?

If rent is due on the 1st and a tenant pays at 11:59 PM on the 1st, are they late? What about time zones? Electronic payment timestamps? We learned that "due date" is surprisingly ambiguous in practice.

Challenge 3: Statute vs. Case Law

Illinois has no late fee statute. Instead, landlords must rely on case law precedent from Collins v. Hurst (2000), which established a "reasonable forecast of damages" standard. Translating case law into a calculator formula required legal interpretation we weren't originally prepared for.

How Community Feedback Made This Tool Better

Building legal compliance tools in isolation is a recipe for blind spots. When we shared RentLateFee.com on Hacker News, the developer community didn't just find bugs; they stress-tested edge cases across multiple states and suggested improvements we hadn't considered.

The result was a complete overhaul of our calculation engine. We rebuilt it with comprehensive unit tests for all five calculation methods. Every state now has explicit test cases covering edge conditions like zero grace periods, maximum rent scenarios, and boundary values for "greater of" and "lesser of" comparisons.

This collaborative approach reinforced why we believe in building in public: legal compliance tools require the kind of exhaustive validation that benefits from many eyes. A bug in a regular calculator is an inconvenience. A bug in a compliance calculator could lead users to break the law. Community input helps us catch issues before they affect real landlords and tenants.

What This Data Means for Landlords and Tenants

Our analysis reveals several actionable insights:

For Landlords

- Know your calculation method. Simply knowing "5%" isn't enough. You need to know if it's 5% OR $50 (greater of) or 5% AND $50 (lesser of).

- Don't forget grace periods. Even a legally-sized fee charged too early is still a violation.

- Document your reasoning. In "reasonable" states, you may need to justify your fee amount. Keep records of actual costs incurred by late payments.

For Tenants

- Check the math. Over 18% of our users discovered potential overcharges by their landlords.

- Verify the grace period. Many landlords don't know their state requires one.

- Request citations. A landlord should be able to point to the specific statute authorizing their fee structure.

The Bigger Picture: Why This Matters

According to the Consumer Financial Protection Bureau, approximately 14% of renters incurred late fees in the 12 months ending November 2024, with the average fee totaling $85. That's millions of transactions governed by a patchwork of 50 different legal frameworks with no federal standardization.

The complexity we've documented isn't just an inconvenience. It's a systemic barrier to legal compliance. When a landlord in California can't get a straight answer about what's "reasonable," or when a landlord in Utah accidentally charges the lesser of two values instead of the greater, the law fails to provide the clarity it should.

We built RentLateFee.com to address this gap: a free tool that shows the exact statutory limit, the applicable grace period, and the legal citation, all in seconds. The data we've gathered over three months confirms that demand for this clarity is substantial and growing.

Try the Calculator

Whether you're a landlord ensuring compliance or a tenant verifying charges, our state-by-state late fee calculator provides instant answers with legal citations. It's free, requires no signup, and works on all 50 states plus DC.

Data in this article reflects 3,625 calculator uses from October 1, 2025 through January 14, 2026. Individual legal situations may vary. Consult an attorney for specific advice.