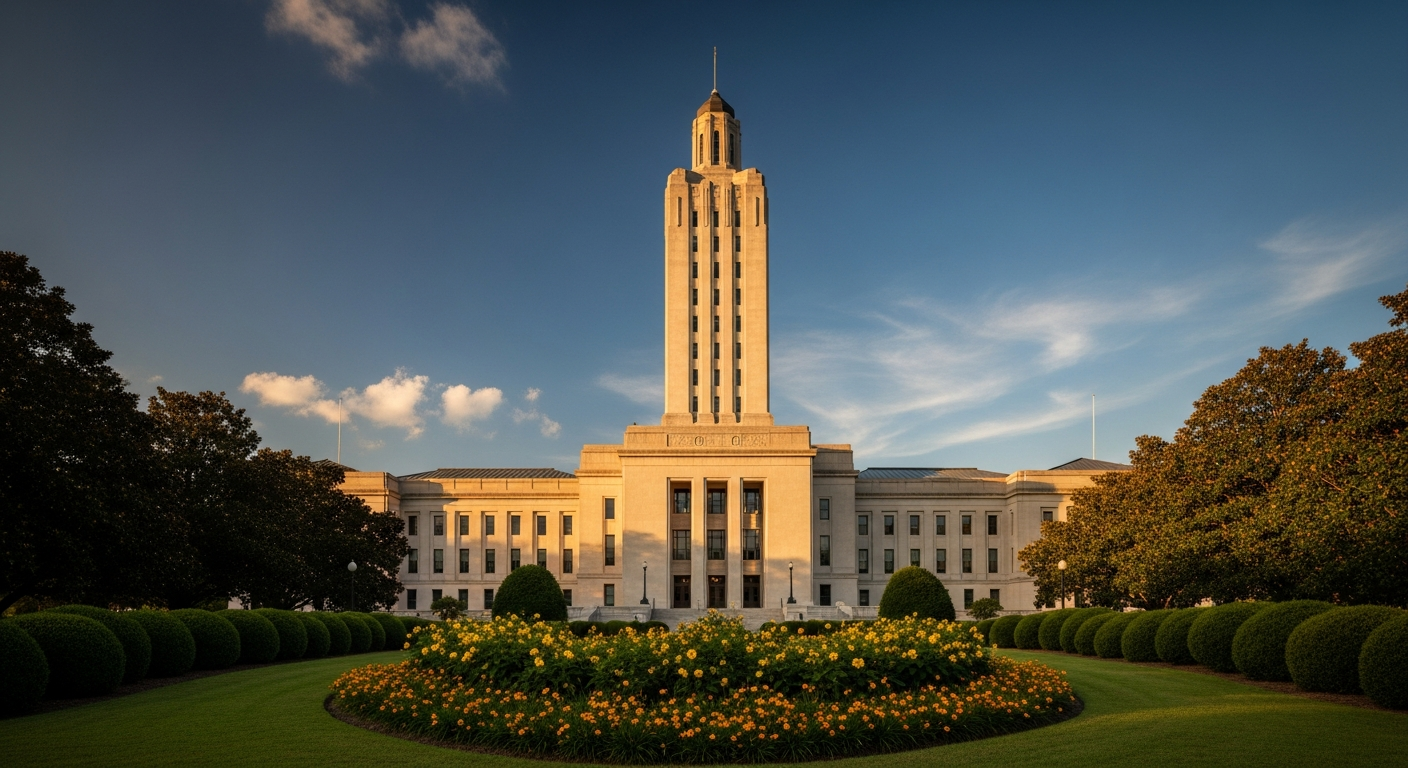

Louisiana Rent Late Fees: 2026 Complete Guide

Louisiana's Unique Civil Law System for Rentals

Louisiana stands apart from all other U.S. states with its civil law tradition derived from the Napoleonic Code, rather than English common law. This fundamental distinction affects how rental agreements and late fees are interpreted under Louisiana Civil Code Title IX, which governs leases and obligations.

Like many landlord-friendly states, Louisiana has no statutory cap on residential rent late fees. However, critical distinctions exist: La. Rev. Stat. § 9:3314 applies only to equipment leases, NOT residential rentals. Understanding Louisiana's civil law framework and industry standards (5-10%) is essential for both landlords and tenants navigating this unique legal landscape.

No Statutory Cap Under Louisiana Civil Code Title IX

Louisiana Civil Code Title IX comprehensively governs leases and obligations, including:

- Lease formation and obligations (Articles 2668-2742)

- Landlord duties (Articles 2682-2695)

- Tenant duties (Articles 2683, 2707-2715)

- Lease termination (Articles 2719-2742)

Notably, Title IX contains no specific provisions limiting late fee amounts for residential rentals. This means:

- No percentage cap: Unlike Oregon (5%) or Hawaii (8%), Louisiana has no statewide maximum

- No flat dollar cap: Unlike Alaska or Iowa, Louisiana doesn't limit total amounts

- Lease agreement controls: Late fees governed by written lease terms and general obligations law

- Civil law "reasonableness": Louisiana courts may void fees deemed unreasonable under principles of cause and good faith

Civil Law Reasonableness Standard

Under Louisiana's civil law system, late fees function as stipulated damages (similar to common law "liquidated damages"). Louisiana Civil Code Article 2005 governs penalty clauses:

- Parties may stipulate damages for breach of contract

- Stipulated damages must not be "unreasonable" or function solely as penalties

- Courts may reduce excessive penalties to reasonable amounts

While no Louisiana appellate case definitively establishes a residential late fee cap, civil law principles suggest fees exceeding 10-15% of monthly rent risk judicial reduction or invalidation.

Sources: Louisiana Civil Code Articles 2005, 2668-2742; Louisiana Law Review analyses

Industry Standard: 5-10% Defensible Range

Despite no statutory caps, Louisiana property management professionals consistently recommend:

Conservative Range: 5-7%

This range aligns with states having explicit caps and is widely considered safe harbor:

- $1,000 rent: $50-$70 late fee

- $1,500 rent: $75-$105 late fee

- $2,000 rent: $100-$140 late fee

Moderate Range: 8-10%

Higher but potentially defensible with proper documentation:

- $1,000 rent: $80-$100 late fee

- $2,000 rent: $160-$200 late fee

Landlords charging in this range should maintain detailed records of actual costs: administrative time, bank fees, opportunity costs, mortgage penalties.

High Risk: Above 10%

Fees exceeding 10% face increasing vulnerability:

- Difficult to justify as reasonable stipulated damages

- May violate Louisiana Civil Code Article 2005

- Increases tenant dispute likelihood

- Could be reduced or voided in eviction proceedings or court

Sources: Louisiana Apartment Association, Greater New Orleans Landlord Association, Baton Rouge Property Management Council

La. Rev. Stat. § 9:3314: Equipment Leases Only—NOT Residential

A critical source of confusion is Louisiana Revised Statutes § 9:3314, which some mistakenly believe applies to residential rentals:

What La. Rev. Stat. § 9:3314 Actually Covers

La. Rev. Stat. § 9:3314 governs movable property and equipment leases, not residential real estate:

- Applies to: Equipment rentals, machinery leases, personal property leases

- Does NOT apply to: Apartments, houses, immovable property, residential real estate leases

- Purpose: Regulates commercial equipment lease terms and remedies

Why the Confusion?

La. Rev. Stat. § 9:3314 addresses lease obligations and remedies, leading some to assume it governs all lease types. It does not. Louisiana's civil law distinguishes between:

- Immovable property leases: Governed by Louisiana Civil Code Title IX (includes residential)

- Movable property leases: Governed by statutes like La. Rev. Stat. § 9:3314

Key Takeaway: La. Rev. Stat. § 9:3314 is irrelevant to residential late fees. Residential rentals fall under Louisiana Civil Code Title IX, which contains no late fee caps.

Source: Louisiana Revised Statutes § 9:3314, Louisiana Civil Code Title IX

No Statutory Grace Period Requirement

Louisiana Civil Code Title IX does not mandate grace periods before late fees apply. Landlords may:

- Charge late fees the day after rent is due (e.g., on the 2nd if rent due on the 1st)

- Implement any grace period they choose (3, 5, 10 days) via lease agreement

- Waive grace periods entirely

Industry Best Practices

Despite no legal requirement, Louisiana property managers typically provide:

- 3-5 day grace period: Most common in professional property management

- 7-day grace period: Common in tenant-friendly markets or subsidized housing

- No grace period: More common in month-to-month or high-risk tenancies

Grace periods:

- Reduce tenant disputes and turnover

- Account for mail delays and payment processing time

- Demonstrate good faith under Louisiana Civil Code Article 1983

- May strengthen landlord's position if fees are challenged

Sources: Louisiana Housing Corporation, Louisiana Apartment Association

Eviction Process and Late Fee Enforcement

Louisiana's eviction process differs from most states due to its civil law tradition:

Rule to Show Cause (Summary Eviction)

Louisiana landlords use a Rule to Show Cause procedure for non-payment evictions:

- No specific notice period: Louisiana doesn't require 3-day or 7-day notices like other states

- Immediate filing: Landlords may file eviction immediately upon non-payment (after any lease-specified grace period)

- Court hearing: Tenant receives summons to show cause why they shouldn't be evicted

- 5-day rule: Court must hold hearing within 5 days (expedited process)

Late Fees in Eviction Proceedings

Unlike many states, Louisiana allows including late fees in eviction amounts, but:

- Fees must be clearly stated in the lease

- Fees must be reasonable (courts may reduce excessive fees)

- Documentation of fee calculations required

- Landlords typically pursue fees through separate collection or deposit deduction to avoid complicating eviction

Sources: Louisiana Code of Civil Procedure Articles 4701-4735, Louisiana Civil Code Article 2704

Key Louisiana Statutes & Legal Framework

Louisiana Civil Code Title IX - Lease Obligations

Governs residential landlord-tenant relationships comprehensively but contains no specific late fee cap provisions.

Louisiana Civil Code Article 2005 - Penalty Clauses

Governs stipulated damages (including late fees):

- Parties may agree to penalty clauses for non-performance

- Courts may reduce excessive penalties

- Penalties must relate to actual damages or harm

Louisiana Civil Code Article 2683 - Tenant Obligations

Requires timely rent payment but doesn't specify late fee limits.

Louisiana Civil Code Article 2707 - Security Deposits

Regulates deposit handling:

- Landlords may deduct unpaid late fees from security deposits

- Itemized statement required within 30 days

- Must return remaining balance to tenant

- Failure to comply: Tenant may recover deposit plus damages/attorney fees

Louisiana Code of Civil Procedure Articles 4701-4735

Governs eviction procedures including Rule to Show Cause process.

La. Rev. Stat. § 9:3314 - Equipment Lease Obligations

Governs movable property leases—does NOT apply to residential rentals.

Sources: Louisiana Civil Code; Louisiana Code of Civil Procedure; Louisiana Revised Statutes Chapter 9

Landlord Best Practices for Compliance

1. Conservative Fee Structures

Without statutory guidance, err on the side of defensibility:

- Recommend 5-7%: Widely accepted and defensible under Louisiana civil law

- Document costs: Maintain records of administrative expenses, bank fees, mortgage penalties

- Flat fees: If using flat fees, keep under $100 for most residential properties

2. Clear Lease Language

Louisiana lease agreements should specify:

- Exact fee amount: "$X or Y% of monthly rent, whichever is less"

- Grace period: "Late fees apply if rent not received by [date]"

- Stipulated damages statement: "This fee represents stipulated damages for late payment, including administrative costs, lost interest income, and potential penalties on Landlord's obligations, as permitted under Louisiana Civil Code Article 2005."

- NSF provisions: "Separate fee for bounced checks as provided by law"

Sample Clause: "If monthly rent is not received by the 5th day of the month, Tenant agrees to pay a late fee of 5% of monthly rent ($X), as stipulated damages under Louisiana Civil Code Article 2005. This fee represents Landlord's reasonable estimate of actual damages caused by late payment. These fees are separate from and in addition to any unpaid rent."

3. Graduated Fee Structures

Consider tiered approaches:

- Days 2-5: $25 or 3% (whichever is less)

- Days 6-15: $50 or 5% (whichever is less)

- After day 16: $75 or 7% maximum

This demonstrates progressiveness under principles of good faith (Louisiana Civil Code Article 1983).

4. Documentation Requirements

If challenged under Louisiana Civil Code Article 2005, landlords should provide:

- Detailed payment history with dates and amounts

- Late fee calculation worksheets

- Evidence of actual costs incurred (mortgage late fees, bank charges, administrative time logs)

- Opportunity cost analysis (lost investment income)

5. Communication and Transparency

- Send rent reminders 3-5 days before due date

- Provide immediate notice when payment not received

- Maintain detailed payment logs and late fee calculations

- Offer payment plans for tenants facing temporary hardship

Tenant Rights & Protections in Louisiana

Challenging Excessive Fees

Louisiana tenants can dispute unreasonable late fees through:

1. Written Dispute to Landlord

Send written notice citing Louisiana Civil Code Article 2005, requesting:

- Breakdown of actual damages the fee represents

- Justification for fee amount as stipulated damages

- Reduction or refund if fee excessive

2. Withholding Disputed Fees

Tenants may pay rent but withhold disputed late fees:

- Dispute must be raised in good faith

- Risk: Landlord may pursue fees through deposit deduction or court

- Louisiana allows late fees in eviction proceedings, complicating this strategy

3. City Court or Justice of the Peace Court

File in appropriate court (jurisdiction varies by parish and amount) for:

- Refund of excessive fees already paid

- Return of improperly deducted security deposit amounts

- Burden on tenant to prove fees are unreasonable under Article 2005

- Courts may reduce excessive penalties to reasonable amounts

4. Security Deposit Dispute

If late fees deducted from deposit:

- Demand itemized statement within 30 days

- Challenge deductions in court if excessive

- May recover deposit plus damages and attorney fees under Louisiana Civil Code Article 2707

Tenant Resources

- Southeast Louisiana Legal Services: Free legal assistance for qualifying low-income tenants

- Louisiana Housing Corporation: Rental assistance and tenant education

- New Orleans Fair Housing Action Center: Housing discrimination and tenant rights advocacy

- Acadiana Legal Service Corporation: Legal aid in southwest Louisiana

Sources: Southeast Louisiana Legal Services, Louisiana Housing Corporation

Common Mistakes Louisiana Landlords Must Avoid

1. Misapplying La. Rev. Stat. § 9:3314 to Residential Rentals

Mistake: Believing La. Rev. Stat. § 9:3314 (equipment lease statute) governs residential late fees

Risk: Misunderstanding regulatory framework; equipment lease laws don't apply to immovable property

Solution: Recognize La. Rev. Stat. § 9:3314 is for movable property only; residential governed by Louisiana Civil Code Title IX

2. Charging Excessive Fees Without Documentation

Mistake: Imposing 12-15% fees without proof of actual damages

Risk: Fees reduced or voided under Louisiana Civil Code Article 2005, tenant refund claims

Solution: Stay within 5-10% safe range, document all actual costs

3. Failing to State Fees as Stipulated Damages

Mistake: Not framing late fees as "stipulated damages" in lease under Article 2005

Risk: Fees may be challenged as unenforceable penalties

Solution: Include explicit language citing Article 2005 and stipulated damages framework

4. Not Providing Grace Periods

Mistake: Charging late fees on day 2 without warning or grace period

Risk: Tenant backlash, higher dispute rates, may violate good faith duty under Article 1983

Solution: Implement 3-5 day grace period as industry standard

5. Improper Security Deposit Deductions

Mistake: Deducting late fees without itemized statement within 30 days

Risk: Forfeiture of deposit deduction rights, tenant recovery of deposit plus damages/fees

Solution: Provide detailed itemization within Louisiana's 30-day deadline per Article 2707

6. Confusing Louisiana Civil Law with Common Law States

Mistake: Applying common law concepts (like "liquidated damages" doctrine) without understanding Louisiana's civil law differences

Risk: Misunderstanding legal framework, incorrect fee structuring

Solution: Consult Louisiana-licensed attorney familiar with civil law tradition

Example Calculations for Louisiana Landlords

Scenario 1: Conservative 5% Fee

- Rent: $1,300/month, due on 1st

- Grace period: Through 5th day

- Payment date: Tenant pays on 8th

- Calculation: $1,300 × 5% = $65 late fee

- Defensibility: Highly defensible under Louisiana Civil Code Article 2005

Scenario 2: Moderate 8% Fee

- Rent: $1,700/month

- Payment: 12 days late

- Calculation: $1,700 × 8% = $136 late fee

- Defensibility: Moderate risk; should document costs (mortgage late fee, administrative time)

Scenario 3: High-Risk 12% Fee

- Rent: $2,200/month

- Fee: $264 (12%)

- Risk: High likelihood of court reduction under Article 2005

- Recommendation: Reduce to $110-$154 (5-7%) or provide exceptional documentation

Scenario 4: Bounced Check Plus Late Fee

- Rent: $1,500/month

- Check bounces: On 3rd (within grace period)

- Cash payment: On 10th (after grace period)

- Calculation:

- NSF fee: Reasonable amount (Louisiana has no specific cap, $25-30 typical)

- Late fee: $1,500 × 5% = $75

- Total: ~$100-105

Scenario 5: New Orleans Market (Typical)

- Rent: $1,000/month

- Grace period: 3 days

- Late fee: 5% = $50

- Common practice: Aligns with local property management standards

Frequently Asked Questions

1. Is there a late fee limit in Louisiana for apartments?

No statutory limit exists. Louisiana Civil Code Title IX has no specific caps on residential late fees. However, fees must be "reasonable" under Article 2005. Industry standards suggest 5-10% of monthly rent is defensible. Fees above 10-15% risk court reduction.

2. Does La. Rev. Stat. § 9:3314 apply to my rental house?

No. La. Rev. Stat. § 9:3314 governs movable property and equipment leases only, not residential immovable property (apartments, houses). Residential late fees are governed by Louisiana Civil Code Title IX, which contains no statutory caps.

3. Do I have to give tenants a grace period in Louisiana?

No legal requirement. Louisiana Civil Code Title IX doesn't mandate grace periods. Landlords can charge late fees the day after rent is due. However, providing 3-5 day grace periods is industry best practice and demonstrates good faith under Article 1983.

4. Can I include late fees in eviction proceedings in Louisiana?

Yes, but with caution. Unlike many states, Louisiana allows including late fees in Rule to Show Cause eviction amounts. However:

- Fees must be clearly stated in lease

- Fees must be reasonable (courts may reduce excessive amounts)

- Many landlords pursue fees separately to simplify eviction

5. What's the maximum bounced check fee in Louisiana?

No specific statutory cap for NSF fees in residential contexts. However, reasonableness applies. Industry practice: $25-30 per bounced check aligns with other states' statutory limits and is defensible.

6. How much can I deduct from security deposits for late fees?

Any properly assessed late fees per the lease agreement, provided:

- Fees don't exceed reasonable amounts (5-10% guideline)

- Itemized statement provided within 30 days of move-out per Article 2707

- Deductions properly documented with dates and calculations

7. How does Louisiana's civil law system affect late fees?

Key differences from common law states:

- Fees treated as "stipulated damages" under Article 2005, not "liquidated damages"

- Courts may reduce excessive penalties even if agreed to in lease

- Good faith duty under Article 1983 requires fair dealing

- Consult Louisiana-licensed attorney for proper interpretation

Conclusion: Navigating Louisiana's Civil Law Framework

Louisiana's unique civil law tradition creates a distinct regulatory environment for residential late fees. Unlike common law states, Louisiana's approach under Civil Code Title IX and Article 2005 emphasizes stipulated damages, good faith, and judicial discretion to reduce excessive penalties.

Key Takeaways

- No state cap: Louisiana Civil Code Title IX has no statutory late fee limit

- Stipulated damages framework: Fees governed by Article 2005, must be reasonable

- 5-10% safe range: Industry consensus for defensible late fees in Louisiana

- La. Rev. Stat. § 9:3314 irrelevant: Equipment lease statute does NOT apply to residential

- No grace period required: But 3-5 days is professional best practice

- Rule to Show Cause: Louisiana's unique eviction process allows including fees (with caution)

- Civil law distinction: Louisiana's framework differs from other states' common law approaches

Action Steps for Landlords

- Implement 5-7% late fees for maximum defensibility

- Provide 3-5 day grace periods to demonstrate good faith

- Draft lease clauses framing fees as "stipulated damages" per Article 2005

- Document all costs: administrative time, bank fees, opportunity costs

- Understand Louisiana's unique Rule to Show Cause eviction process

- Provide itemized deposit statements within 30 days per Article 2707

- Ignore La. Rev. Stat. § 9:3314 (it's for equipment, not residential)

- Consult Louisiana-licensed attorney familiar with civil law tradition

- Use RentLateFee.com calculator to verify fee reasonableness

Action Steps for Tenants

- Review lease late fee provisions before signing

- Challenge fees exceeding 10% under Louisiana Civil Code Article 2005

- Request written justification of stipulated damages

- Understand Louisiana's unique eviction process and fee inclusion

- Contact Southeast Louisiana Legal Services for assistance

- Verify security deposit itemizations within 30-day deadline

- File court action to challenge excessive fees or deposit deductions

- Know that La. Rev. Stat. § 9:3314 doesn't protect residential tenants

Louisiana's civil law framework requires both landlords and tenants to understand unique legal principles differing from other states. By following industry best practices, framing fees properly as stipulated damages, and demonstrating good faith, both parties can navigate this distinctive legal landscape successfully.

Need to verify if your late fee complies with Louisiana civil law? Use the RentLateFee.com Calculator for instant Louisiana-specific analysis with Civil Code Article 2005 reasonableness assessment.

Last Updated: November 21, 2025. This guide provides general information and should not be construed as legal advice. Consult a Louisiana-licensed attorney for specific situations involving Louisiana's civil law system.

🔗 Related State Guides

Understanding late fee regulations in neighboring states can help you compare different approaches and understand regional trends. Here are related state guides:

1. Texas Rent Late Fee Guide

Why it's relevant: Neighboring state

2. Mississippi Rent Late Fee Guide

Why it's relevant: Neighboring state

3. Arkansas Rent Late Fee Guide

Why it's relevant: Neighboring state

4. Florida Rent Late Fee Guide

Why it's relevant: Gulf Coast comparison

Additional Resources

- Rent Late Fee Calculator - Calculate your state's legal maximum

- Rent Grace Period Laws by State - Compare grace period requirements

- Security Deposit Laws - Understand deposit regulations