Ranking All 50 States by Rent Late Fee Strictness: A Data-Driven Analysis

The Complete State-by-State Late Fee Ranking

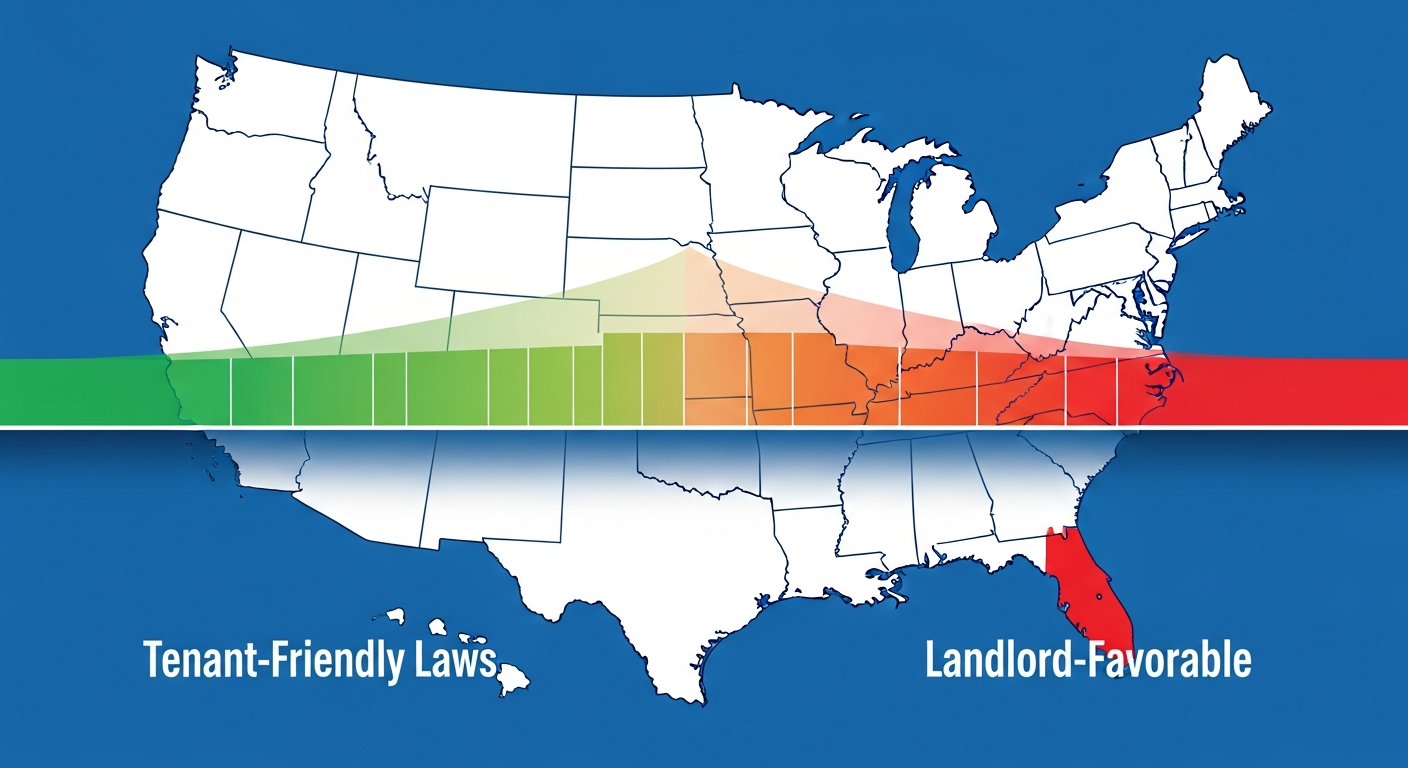

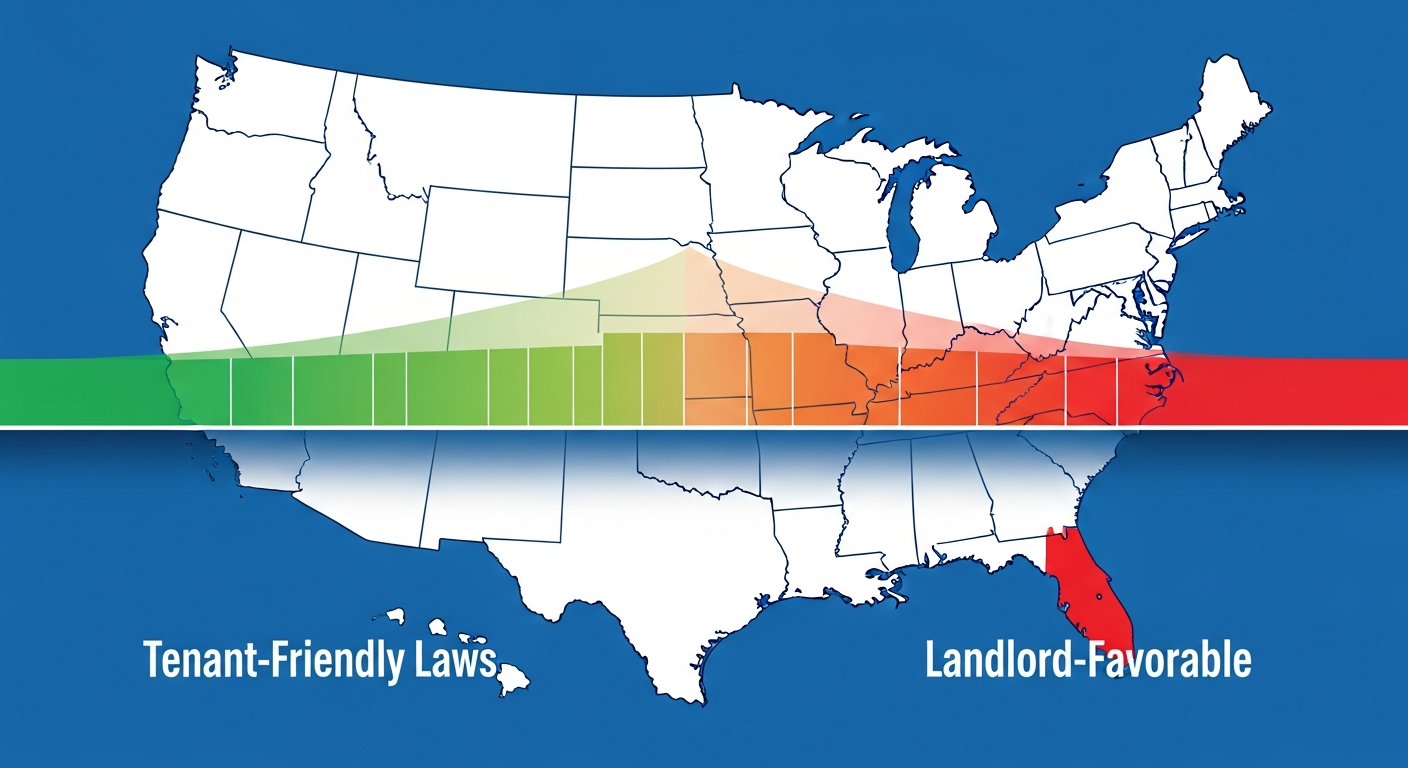

Not all late fee laws are created equal. After analyzing statutes, court cases, and regulatory frameworks across all 50 states, we've ranked them from most tenant-friendly to most landlord-favorable.

This isn't about which approach is "better." It's about understanding the spectrum and where your state falls.

The Most Tenant-Friendly States (Rank 1-10)

1. Maine: The 4% Cap

Maximum late fee: 4% of monthly rent. Grace period: 15 days required. Maine combines one of the lowest percentage caps in the nation with an exceptionally long grace period, making it the most tenant-protective state for late fees. Per Title 14, §6028.

2. Maryland: 5% Maximum

Maryland caps late fees at 5% of monthly rent with a mandatory 5-day grace period. Simple, predictable, and relatively low. A $1,500 rent can incur maximum $75 in late fees.

3. Delaware: $40 Dollar Cap

Like Maine, Delaware uses a flat dollar cap ($40) rather than a percentage. Combined with a 5-day grace period requirement, this is highly protective of tenants.

4. New York: $50 or 5% (Lesser Of)

New York's "lesser of" formula creates a ceiling: even for high rents, the fee caps at $50 after the 5-day grace period. Landlords often don't realize this and charge illegal amounts.

5. Massachusetts: No Specific Statute

While Massachusetts has no specific late fee statute, courts have consistently ruled that fees must be "reasonable" and represent actual damages. In practice, this has resulted in fees being capped at 5-10% by case law precedent.

6. Connecticut: 5% Cap with Teeth

Connecticut caps fees at 5% and requires a 9-day grace period. The state's aggressive enforcement of tenant protection laws adds weight to this cap.

7. North Carolina: 5% or $15 Maximum

North Carolina caps late fees at 5% of monthly rent OR $15, whichever is greater, but only after a 5-day grace period. For lower rents, the $15 minimum provides landlords some recovery.

8. New Hampshire: 5% with Documentation

New Hampshire allows 5% late fees but requires landlords to document actual costs incurred due to late payment. This "actual damages" approach limits punitive fees.

9. Oregon: 5% Maximum After Grace Period

Oregon's 5% cap comes with a mandatory 4-day grace period and prohibits late fees during the first week of a new tenancy.

10. Vermont: Reasonable Standard with Strong Courts

Vermont's "reasonable" standard is enforced by tenant-friendly courts that have consistently struck down fees exceeding 5% of rent.

The Middle Ground (Rank 11-30)

Most states fall into a middle category where late fees are regulated but not aggressively capped:

| Rank | State | Maximum Fee | Grace Period |

|---|---|---|---|

| 11 | Illinois | Reasonable (~5-8%) | 5 days by practice |

| 12 | Washington | Reasonable | None required |

| 13 | Nevada | 5% cap | 3 days required |

| 14 | New Jersey | Reasonable (~5-6%) | 5 days by practice |

| 15 | Virginia | 10% or reasonable | 5 days |

| 16 | Colorado | Reasonable | None required |

| 17 | Wisconsin | Reasonable | None required |

| 18 | Minnesota | 8% cap | None required |

| 19 | Michigan | Reasonable | None required |

| 20 | Ohio | Reasonable | None required |

| 21 | Pennsylvania | Reasonable | None required |

| 22 | Iowa | Reasonable | None required |

| 23 | Kansas | Reasonable | None required |

| 24 | Nebraska | Reasonable | None required |

| 25 | Missouri | Reasonable | None required |

| 26 | Indiana | Reasonable | None required |

| 27 | Kentucky | Reasonable | None required |

| 28 | Tennessee | 10% or $30 greater | 5 days |

| 29 | South Carolina | Reasonable | None required |

| 30 | West Virginia | Reasonable | None required |

The Most Landlord-Favorable States (Rank 31-50)

41-50: Minimal Regulation

These states provide landlords maximum flexibility in setting late fees:

50. Texas: 12% for Small Buildings, 10% for Large

Texas allows up to 12% late fees for buildings with 4 or fewer units, and 10% for larger properties with more than 4 units. Combined with only a 2-day grace period requirement, this is one of the most landlord-favorable frameworks. Per Tex. Prop. Code § 92.019.

49. Georgia: No Cap, No Grace Period

Georgia has no statutory cap on late fees and no mandatory grace period. Market forces and lease terms are the only constraints.

48. Florida: No Cap Required

Florida requires late fees to be "reasonable" but courts have upheld fees as high as 10-15% in some cases. No grace period is required by statute.

47. Alabama: Minimal Regulation

Alabama has no specific late fee statute. Landlords can charge what the lease specifies, subject only to general contract law principles.

46. Utah: 10% or $75 (Greater Of)

Utah's "greater of" formula actually benefits landlords on lower-rent properties by guaranteeing a minimum $75 fee regardless of rent amount.

45. Arizona: No Statutory Cap

Arizona requires only that fees be "reasonable" with minimal court guidance on what that means. Many landlords charge 5-10% without legal challenge.

44. Oklahoma: No Statutory Cap

Oklahoma has no specific late fee statute. Market norms and lease agreements govern.

43. Louisiana: No Specific Statute

Louisiana's Civil Code addresses lease agreements generally but doesn't cap late fees specifically.

42. Mississippi: Minimal Regulation

Mississippi has no statutory cap on late fees. Landlords have significant discretion.

41. Arkansas: No Statutory Cap

Arkansas allows landlords to set late fee terms in the lease with minimal regulatory oversight.

What This Ranking Means for You

For Landlords:

- Know your state's specific rules before setting late fees in your lease

- Even in landlord-favorable states, courts may still strike down excessive fees

- Documentation of actual costs helps defend late fee policies

For Tenants:

- Check if your state has a statutory cap. Many landlords charge above it unknowingly

- Request documentation of how late fees were calculated

- Understand your grace period rights

Calculate Your State's Maximum

Use our Late Fee Calculator to see exactly what's legal in your state. Enter your rent amount and get state-specific calculations with citation to the relevant laws.